PDF) BINOMIAL MODEL FOR MEASURING EXPECTED CREDIT LOSSES FROM TRADE RECEIVABLES IN NON-FINANCIAL SECTOR ENTITIES

Receivables-MFRS9 - Lecture notes 1 - RECEIVABLES – MFRS/IFRS 9 Objectives of providing information - Studocu

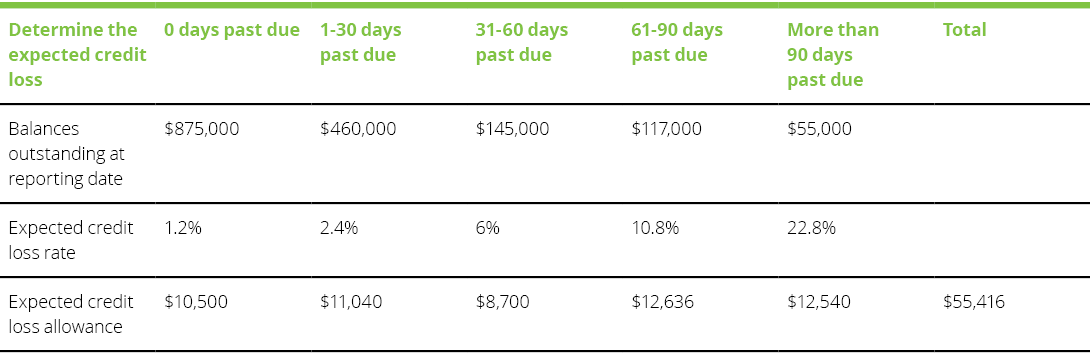

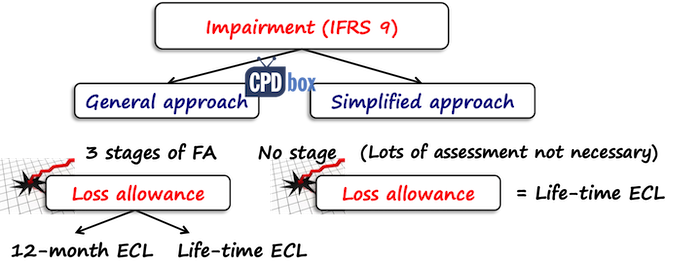

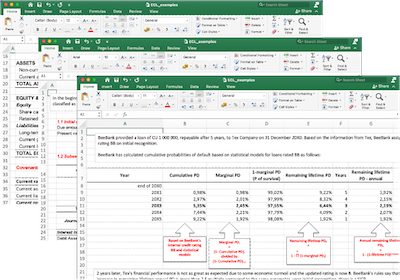

IFRS 9, simplified approach for trade receivables, policy, judgements and estimates and disclosures including credit risk – Accounts examples

IFRS 9 para 5.5.15 simplified approach for trade receivables and contract assets, disclosures for receivables and contract assets and liabilities – Accounts examples

IFRS 9, simplified approach for trade receivables, policy, judgements and estimates and disclosures including credit risk – Accounts examples